Contents

Overview of AI functions in finance: What Are The Future Developments In AI Purposes For Finance?

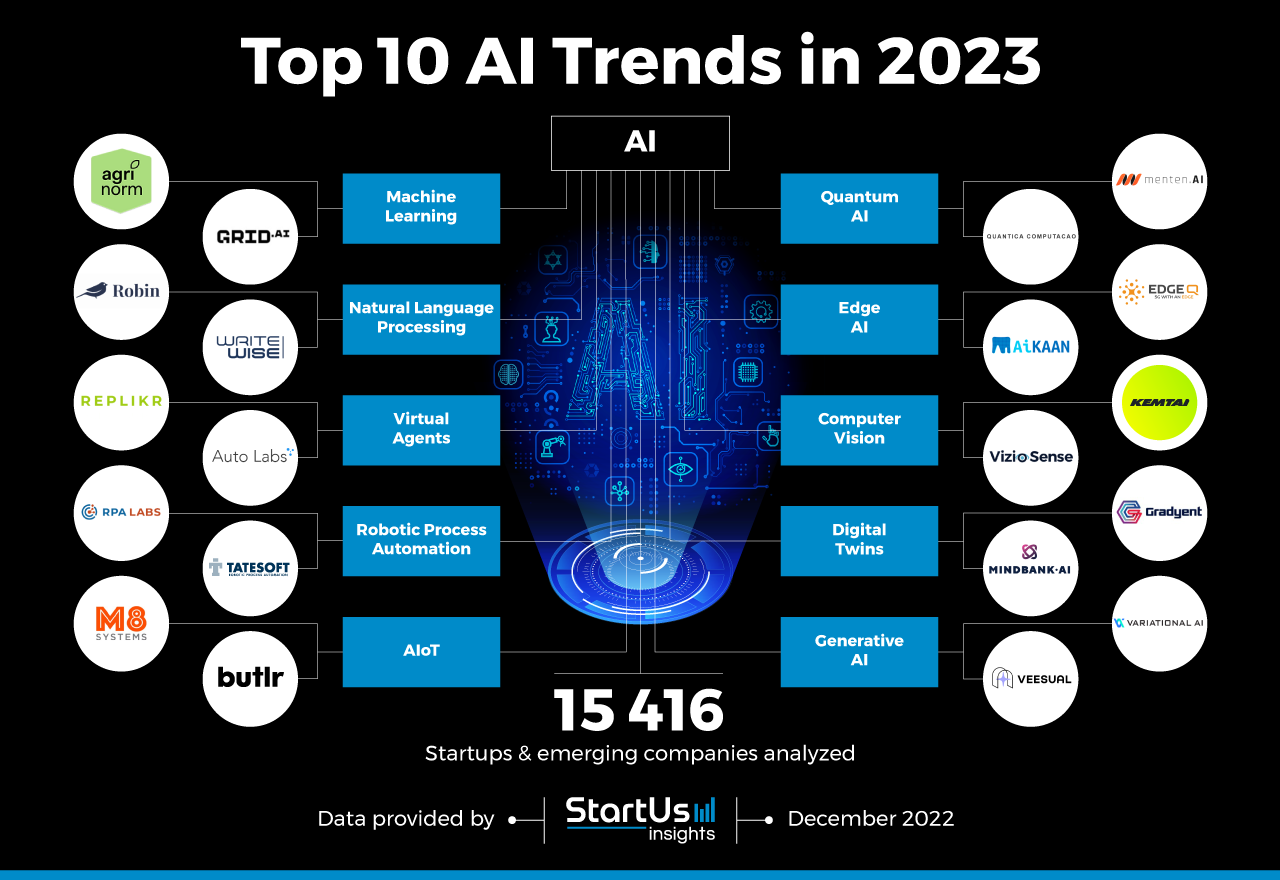

AI functions have revolutionized the finance trade by offering superior instruments and applied sciences to optimize processes, enhance decision-making, and improve buyer expertise. These functions leverage machine studying algorithms, pure language processing, and information analytics to extract insights from huge quantities of monetary information.

Automated Buying and selling

- AI algorithms are used to research market tendencies, predict value actions, and execute trades at excessive speeds.

- This know-how helps merchants make knowledgeable selections based mostly on real-time information and reduce dangers.

Fraud Detection

- AI programs can establish uncommon patterns in transactions, detect fraudulent actions, and forestall monetary losses.

- By constantly studying from new information, these programs turn into extra environment friendly in detecting and stopping fraud over time.

Buyer Service

- Chatbots and digital assistants powered by AI present personalised buyer assist, reply queries, and streamline communication processes.

- This know-how enhances buyer expertise by providing 24/7 help and fast responses to buyer inquiries.

Threat Administration

- AI algorithms analyze historic information, assess credit score dangers, and predict potential defaults, serving to monetary establishments make knowledgeable lending selections.

- These programs allow banks and lenders to handle dangers extra successfully and enhance total portfolio efficiency.

Algorithmic Buying and selling

- AI-driven algorithms can execute complicated buying and selling methods, optimize portfolios, and reduce transaction prices in monetary markets.

- These programs can adapt to altering market circumstances and make split-second selections to maximise returns for buyers.

Automation and effectivity in monetary duties

AI performs an important function in enhancing automation and effectivity in numerous monetary duties. By leveraging superior algorithms and machine studying capabilities, AI programs are capable of streamline processes, cut back errors, and enhance total productiveness within the finance trade.

Streamlined Knowledge Processing

AI functions are capable of course of huge quantities of monetary information at a a lot sooner charge in comparison with conventional strategies. This not solely saves time but additionally ensures accuracy in duties similar to information entry, reconciliation, and reporting. For instance, AI-powered software program can routinely extract related info from paperwork, invoices, and receipts, eliminating the necessity for guide information entry and decreasing the danger of human error.

Threat Administration and Compliance

AI algorithms can analyze and assess dangers in real-time, enabling monetary establishments to make knowledgeable selections shortly and successfully. By automating threat administration processes, AI helps organizations establish potential threats, detect fraudulent actions, and guarantee compliance with rules. This proactive strategy enhances safety measures and minimizes monetary dangers for companies.

Personalised Buyer Experiences

AI-driven automation in finance permits for personalised buyer experiences by tailor-made suggestions, focused advertising and marketing campaigns, and environment friendly customer support. By analyzing buyer habits and preferences, AI programs can anticipate wants and provide related monetary services. This not solely enhances buyer satisfaction but additionally will increase buyer retention and loyalty.

Comparability with Conventional Strategies

When evaluating conventional strategies with AI-driven automation in finance, some great benefits of AI turn into evident. Whereas conventional processes rely closely on guide intervention and are liable to human error, AI programs provide pace, accuracy, and scalability. Furthermore, AI can deal with complicated duties with precision, liberating up human assets to concentrate on strategic decision-making and innovation.

Threat administration and fraud detection

AI has revolutionized threat administration and fraud detection within the finance trade by offering superior instruments and algorithms to reinforce safety measures and cut back monetary fraud.

AI in Threat Administration, What are the long run tendencies in AI functions for finance?

AI algorithms are utilized to research huge quantities of knowledge in real-time, enabling monetary establishments to establish potential dangers and make knowledgeable selections to mitigate them. Machine studying fashions can detect patterns and anomalies that human analysts might overlook, bettering threat evaluation accuracy.

- AI-powered predictive analytics can forecast market tendencies and assess credit score dangers extra successfully.

- Robo-advisors use AI algorithms to offer personalised funding recommendation based mostly on particular person threat profiles and monetary objectives.

AI in Fraud Detection

AI instruments play an important function in detecting and stopping fraudulent actions within the monetary sector. By constantly monitoring transactions and person habits, AI algorithms can shortly establish suspicious patterns and flag potential fraud instances for additional investigation.

- Machine studying algorithms can analyze historic transaction information to establish irregularities and potential fraudulent actions.

- Behavioral biometrics and anomaly detection algorithms improve safety measures by recognizing unauthorized entry makes an attempt and fraudulent habits.

Personalised buyer experiences

AI know-how is revolutionizing the finance sector by enabling personalised buyer experiences. By leveraging superior algorithms and machine studying, AI-powered programs can tailor monetary providers to satisfy the distinctive wants of particular person purchasers. This customization not solely enhances buyer satisfaction but additionally performs an important function in retaining purchasers in a extremely aggressive market.

Personalized Companies

AI-driven programs analyze huge quantities of knowledge to achieve insights into buyer preferences, behaviors, and monetary objectives. This info permits monetary establishments to supply personalised providers, similar to tailor-made funding suggestions, custom-made financial savings plans, and individualized mortgage choices. By understanding every consumer’s particular necessities, AI helps in delivering extra related and priceless monetary options.

Improved Buyer Satisfaction

Personalised buyer experiences result in larger ranges of satisfaction as purchasers obtain providers that align with their expectations and objectives. AI know-how can predict buyer wants, anticipate future monetary selections, and proactively provide help or recommendation. By offering a seamless and personalised expertise, monetary establishments can strengthen their relationships with purchasers and foster belief and loyalty.

Enhanced Buyer Retention

The power to supply personalised providers based mostly on AI insights considerably contributes to buyer retention. When purchasers really feel understood and valued by their monetary suppliers, they’re extra prone to stay loyal and proceed utilizing their providers. By constantly refining and optimizing personalised buyer experiences, monetary establishments can construct long-lasting relationships and enhance buyer retention charges.